LIBOR Replacement – The “Two Benchmark” Approach

BIS paper and “two-benchmark” approach

The March 2019 issue of the BIS Quarterly Review published a paper titled “Beyond LIBOR: a primer on the new reference rates”. (See here.) As its title suggests, the paper presents a non-technical introduction to new reference rates such as SOFR intended to replace LIBOR. What’s interesting about the paper is that it discusses a “two-benchmark” approach to replacing LIBOR. The approach entails the concurrent use of a risk-free benchmark rate and a credit-sensitive benchmark rate, and presents a potential solution to the “loss of credit premium” quagmire that I discussed in my previous posting (here).

Divergences between risk-free and credit-sensitve rates

As I discussed in my previous posting, SOFR, a risk-free rate, is not intended to fully replace LIBOR, which incorporates a term credit risk premium. A credit-sensitive benchmark rate may still be desirable, particularly for cash market participants.

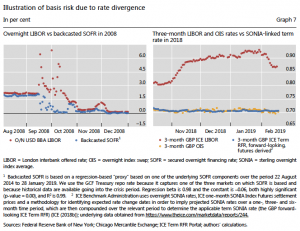

The BIS paper recognizes this need for a credit-sensitive benchmark. In particular, the BIS paper illustrates the potentially significant divergences between a risk-free rate (eg, SOFR) and a counterpart risk-sensitive rate (eg, LIBOR) during both normal times and times of stress. The charts below from Graph 7 of the BIS paper compare the O/N LIBOR with SOFR in 2008, and the 3m GBP (British Pound Sterling) LIBOR with futures-linked SONIA in 2018. (Note: SONIA, “Sterling Overnight Interbank Average”, is an unsecured O/N money market wholesale rate, and the British equivalent of SOFR.)

The charts show that in 2008, the O/N LIBOR surged above 6%, while the SOFR rates plunged from above 1.5% to nearly 0%. Even in normal times, the 3m GBP LIBOR rose by ~10 bps at the end of 2018, while the 3m SONIA rates implied from futures contracts remained nearly unchanged.

Reformed LIBOR, LIBOR+

As a result of the potentially substantial divergences between risk-free and risk rates, I posited in my previous post that the cash market participants are left with 3 options, none of which is satisfactory: (1) Continue to use LIBOR; (2) Adopt SOFR + a fixed spread; and (3) Use other rates having a credit component, such as PRIME, FHLB, commercial paper, CD, AMERIBOR, ICE Bank Yield Index, new auction-based rates, Investment Grade SOFR, etc. The BIS paper, on the other hand, discusses another choice as a part of the “two-benchmark” approach. – A reformed LIBOR, or LIBOR+.

LIBOR+, was proposed in a 2014 report (here) prepared by the Market Participant Groups (MPG), which was established by the Financial Stability Board (FSB) to study the reforms of benchmark interest rates. The results of the MGP report was summarized by Duffie & Stein in 2015 (here), which was in turn referred to by the BIS paper with respect to the “two-benchmark” approach. According to Duffie & Stein, in essence, LIBOR+ broadens the sources of unsecured wholesale funding transactions to those between all counterparties (specifically CPs & CDs), in addition to inter-bank transactions. Broadening the sources can increase the number of transactions underlying the benchmark, and thus reduce the risks of manipulation. Additionally, an algorithm can be used to fix the LIBOR+ rates even if submissions from panel banks are insufficient, reducing the risks to financial stability. (For example, on any day t, if a bank does not have any available transaction, the algorithm can derive the rate for the specific bank by using the transactions in the previous t-k days, giving increasingly smaller weightings to days farther away in the past.)

“Two-benchmark” = RFR & LIBOR+

According to the BIS paper, many countries have opted for the “two-benchmark” approach by choosing a RFR complemented by a local LIBOR+. (“In Japan, the reformed TIBOR will coexist with TONA; and in the euro area, there is an ongoing effort to reform EURIBOR to complement ESTER.” “In Australia, the reformed BBSW [will complement] the O/N benchmark” rate. “In Canada, the liquidity under CDOR, which is based on the bankers’ acceptance market, had actually been on the rise […], making its retention as a credit-sensitive term benchmark that much easier.”) In US, such a “two-benchmark” approach means SOFR will co-exist with LIBOR+ (or other alternatives), with the risk-free SOFR being used primarily for derivatives or for securities issued by agencies or corporations, and the credit-sensitive LIBOR+ used primarily for other cash market products.

Uncertainties

Such a “two-benchmark” approach may cause fragmentation and segmentation in the interest rate markets, reducing liquidity, and causing confusions, among other potential issues and difficulties. Furthermore, it is uncertain whether LIBOR+ can pass muster with the markets or regulators, and whether other alternative credit-sensitive benchmark rates, such as ICE Bank Yield Index, may out-compete LIBOR+. Or, it is possible that markets may reject the “two-benchmark” approach and instead adopt SOFR + a fixed spread, if the SOFR market liquidity becomes attractive and the benefit of a single rate outweighs the lack of a credit premium. Only time will tell, although the clock may be ticking!!!