EU Benchmark Regulations “representative” requirement

In a speech on 7/12/2018, the head of the British financial regulator, FCA (Financial Conduct Authority), Andrew Bailey, declared that the regulator could prohibit LIBOR from continuing to be used for new businesses, if it determines that LIBOR no longer sufficiently “represents” the market. (EU Benchmark Regulations, Article 11(1)(a): “[T]he input data [of a benchmark] shall be sufficient to represent accurately and reliably the market or economic reality that the benchmark is intended to measure.”) Such a determination might not have been overly difficult, if LIBOR had remained a poll-based benchmark. As Mr. Bailey asserted in the same speech, “[LIBOR] relies on the so-called judgment of the panel banks. […] [T]o continue in the new regulated world of benchmarks, LIBOR has to be representative. I struggle to see the case for this judgment.”

LIBOR, however, has evolved.

Reformed LIBOR and permissible “waterfall” input data

ICE, the administrator of LIBOR, has reformed LIBOR to incorporate a “waterfall” of input data types, including transactions, transaction-derived data, and expert judgments. (See here.) Moreover, the EU Benchmark Regulations explicitly permit an interest rate benchmark to incorporate these hybrid types of input data. (See table below.)

Determining “representative”

Since the EUBMR explicitly permit an interest rate benchmark to incorporate such “hybrid” input data types, the Reformed LIBOR can satisfy the “representative” requirements even if it incorporates non-transactional data (e.g., judgments). The question then is: How does one determine whether the Reformed LIBOR is “representative”? According to what criteria? What are the parameters and factors to be used?

The EUBMR do not provide a clear answer to these questions. However, logically such a determination may depend on the following factors, among others:

• Total number of input data;

• Total number of transactional data;

• Total number of judgments;

• Percentage of transactional data;

• Percentage of judgments;

• Variations in the numbers & percentages;

• Etc.

Recognizing the shrinking unsecured interbank funding markets, the Reformed LIBOR broadens the sources of its transaction data to include certificates of deposit and commercial papers. Whether the expansion in data sources will be sufficient to satisfy the “representative” requirements, however, remains uncertain.

ICE Bank Yield Index

In a clear effort to further expand the sources of transactional data, ICE created the Bank Yield Index (BYI) to supplement LIBOR as a credit-sensitive interest rate benchmark. According to ICE, BYI is derived from two types of input data:

- Wholesale, primary market funding transactions executed by large, internationally active banks (e.g. inter-bank deposits, institutional certificates of deposit and commercial paper); and

- Secondary market transactions in wholesale, unsecured bonds issued by large, internationally active banking groups.

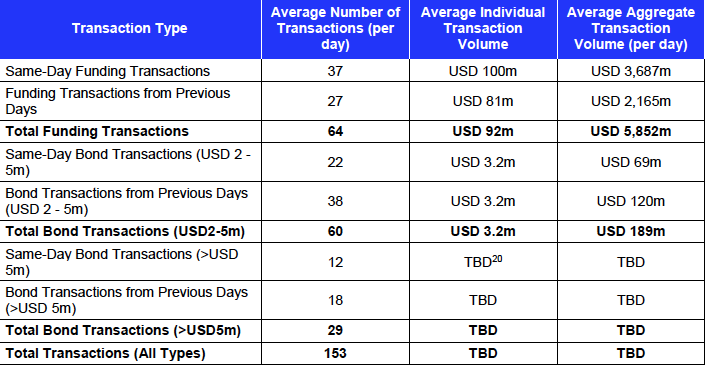

Below figure shows the average numbers and volumes of transactions underlying BYI. (See here.)

Will these expanded data satisfy the “representative” requirements? The answer remains blowing in the wind! The regulators will eventually need to step up to resolve the issue.