NYDFS requirements

In December last year, the NYDFS (New York Department of Financial Services) required each of the regulated financial institutions supervised by NYDFS to submit a plan for addressing the LIBOR cessation and transition risks. Reflecting the urgency of the regulator’s concerns, the institutions were required to submit the plan within less than 2 months, by early February this year. (The deadline was later postponed by 45 days to late March.)

Specifically, NYDFS required the plan to include the following 5 items, without providing further details:

- Programs that would identify, measure, monitor and manage all financial and non-financial risks of transition;

- Processes for analyzing and assessing alternative rates, and the potential associated benefits and risks of such rates both for the institution and its customers and counterparties;

- Processes for communications with customers and counterparties;

- A process and plan for operational readiness, including related accounting, tax and reporting aspects of such transition; and

- The governance framework, including oversight by the board of directors, or the equivalent governing authority, of the regulated institutions.

Analyzing & assessing alternative rates – What is required?

Financial institutions subject to the requirements are likely scrambling to put together a LIBOR transition plan to meet the deadline. Toward this effort, the 2nd required item (“processes for analyzing & assessing alternative rates) seems to pose the lowest hurdle. After all, the ARRC (Alternative Reference Rates Committee), with the implicit approval & supports by the FRB, has chosen SOFR to replace LIBOR; more than $300b of cash instruments have been issued; the daily trading volumes of the SOFR futures contracts set a record, exceeding 80k contracts, recently; and LCH cleared more than $200b of SOFR swaps in January 2020. Moreover, Fannie Mae & Freddie Mac announced on 2/5 that they would no longer accept ARMs based on LIBOR by the end of 2020, and that they planned to begin accepting ARMs based on SOFR later in 2020.

Choosing SOFR, therefore, seems to be a path of the least resistance, particularly for budget-constrained institutions. In that case, the descriptions for item #2 should be simple and straightforward.

However, it is not clear at this point what additional information NYDFS will require for item #2 even if an institution simply decides to choose SOFR to replace LIBOR, as recommended by ARRP. Does the plan need to describe how the institution reached the decision to choose SOFR? Does the plan need to compare, analyze and assess the benefits & risks of other alternative rates? Does the institution need to discuss with its customers and counterparties and incorporate their positions and preferences into the analyses & assessments? Does the plan need to analyze and assess compliance with the 19 IOSCO principles?

Regardless of what the regulator(s) will specifically require in the LIBOR transition plan regarding alternative rates, and notwithstanding the fact that ARRC has recommended SOFR, it should be recognized that one size may not fit all. SOFR may not be the most appropriate replacement for LIBOR for some institutions, such as community and regional banks that depend substantially on unsecured funding. Furthermore, the regulator(s) may require an institution to develop and describe an independent and complete process & framework for analyzing and assessing alternative rates, even if the institution chooses SOFR to replace LIBOR. The spike in the repo market volatility in mid-September last year exemplified some of the shortcomings of SOFR, and demonstrated the need to be abreast of the pros & cons of other alternative rates.

Other alternative rates

If an institution desires or is required to analyze and assess alternative rates, what would be the right approach? In April last year, the Federal Reserve gave a broad-stroke clue that a bank should “conduct at least as much due diligence on the reference rates that they use as they conduct on the creditworthiness of the borrowers”.

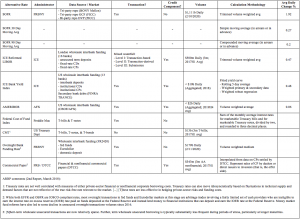

To get started on this due diligence process, the table below lists information associated with some of the alternative rates. The information may be helpful to form the basis for developing a due diligence process to analyze and assess the alternative rates for replacing LIBOR, as required by NYDFS & FRB. Other currently available alternative rates not listed in the table include OIS, Effective Fed Funds, PRIME, Certificate of Deposit, Cost of Savings Index, etc.